Clay County Missouri Real Estate Records

Real Estate Clay County, MO

Real Estate 2025 Value Informal Meetings The window to schedule a 2025 Informal meeting has closed. To appeal to the Board of Equalization please visit the Board of Equalization (BOE) and Taxation. Appeals must be submitted by July 14, 2025. Additional Appeal Resources - How to Appeal Real Estate Value or Classification (PDF) - Suggested Data for a Property Classification Change (PDF) - Suggested Data for a Property Value Change...

https://www.claycountymo.gov/222/Real-Estate

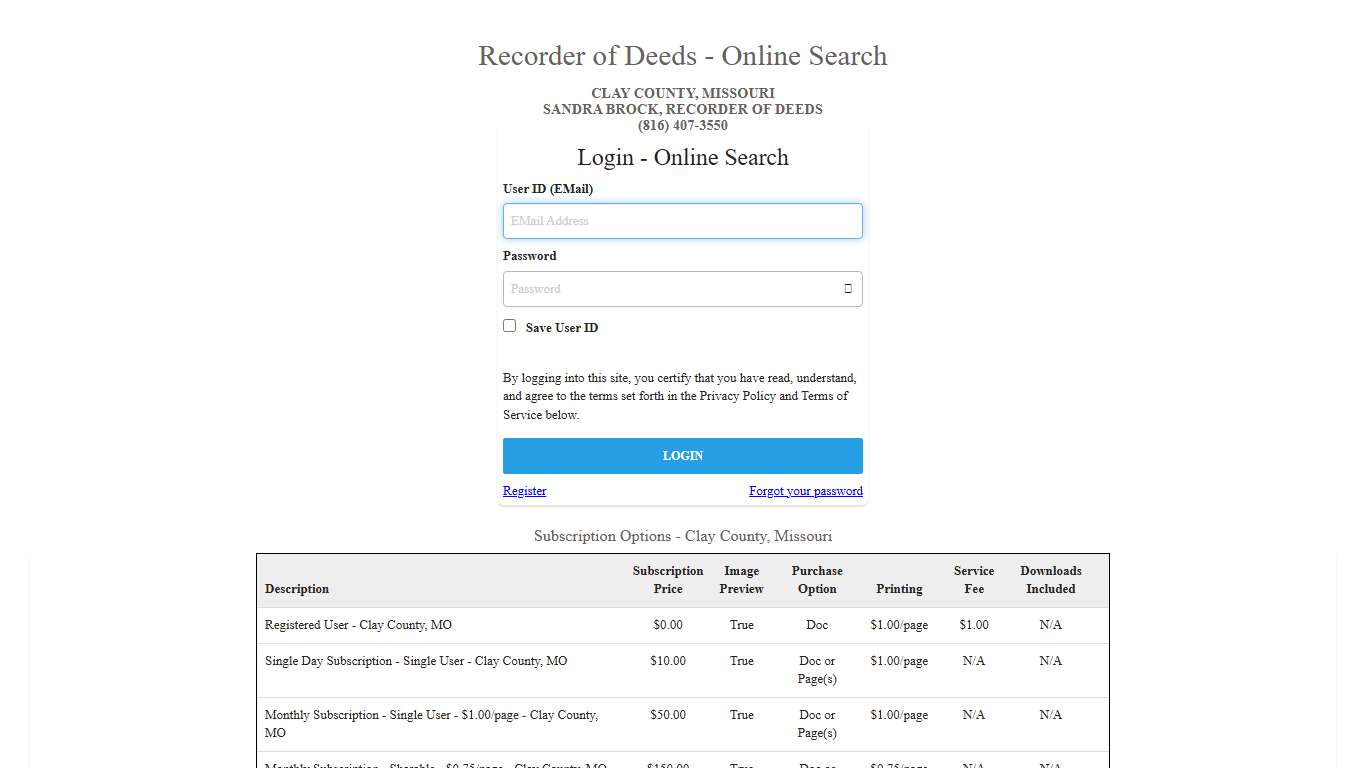

Recorder of Deeds Clay County, MO

Recorder of Deeds The Recorder of Deeds is responsible for recording many types of documents including: - Real Estate Deeds - Subdivision Plats - Surveys - Powers of Attorney - Tax Liens (State and Federal) - Uniform Commercial Code Documents (real estate only) - Military Discharges - Marriage Licenses This list is not exhaustive but shows the more commonly recorded items.

https://www.claycountymo.gov/253/Recorder-of-Deeds

Clay County Collector - Kansas City, Missouri

2025 Tax Bills Now Available* Most Clay County residents can now view and pay 2025 tax bills by logging into our billing portal or visiting our office.** Online payments may take up to 24 business hours before processing. Most Clay County residents can now view and pay 2025 tax bills by logging into our billing portal or visiting our office.** Online payments may take up to 24 business hours before...

https://claycountymo.tax/

Clay County, MO Official Website

The tax bills for the parcels enrolled in the Senior Real Estate Property Tax Relief program are available online. Payments for these parcels may be made by check, cashier’s check, or money order. Read on... The 2026 application and renewal period for the Senior Real Estate Property Tax Relief Program is now open from January 1st, 2026 to March 31st, 2026.

https://www.claycountymo.gov/

iRecord Search - Clay County, Missouri

Recorder of Deeds - Online Search. Clay County, Missouri Sandra Brock ... , all rights reserved. v4.25.06.05 (WS2) Support Information Privacy ...

https://claymo.icounty.com/

Clay County, MO Property Records Owners, Deeds, Permits

Instant Access to Clay County, MO Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Clay County, Missouri, has 22 municipalities. In Clay County, MO, property records contain real estate information comprising ownership facts, historical transaction data, legal descriptions, and property valuations.

https://missouri.propertychecker.com/clay-county

NETR Online • Clay • Clay Public Records, Search Clay Records, Clay Property Tax, Missouri Property Search, Missouri Assessor

Select: Clay County Public Records The Show-Me State Clay Recorder (816) 407-3550 Clay Collector (816) 407-3200 Clay Assessor (816) 407-3500 Clay Municipality Taxing Districts Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/MO/county/claySeniors, it’s time for... - Clay County, Missouri Government Facebook

Need an exemption completed for property and home tax for Combat Veterans. Our Clay County is doing so poorly for Veterans that if you compare Kansas and Florida, this county is a shame for the one that fights for the freedom you all enjoy. It's a shame we are less than 1,% of freedom defendants.

https://www.facebook.com/claycountymo/posts/seniors-its-time-for-the-2026-application-and-renewal-period-for-the-senior-real/1200781622244422/

Tax Sale - Clay County Collector

Tax Sale This office DOES NOT partner with or endorse Title Bridge, and will not accept any due diligence performed by them. The Office of Collector coordinates all required due diligence for its investors. Only due diligence approved by the Office of Collector will be accepted in exchange for a Collector’s Deed and reimbursed as part of a redemption (see RSMO 140.405.7).

https://claycountymo.tax/tax-sale/

2026 Senior Property Tax Relief Enrollment Period Open — 102.7FM KPGZ

The application and renewal period for the Clay County Senior Real Estate Property Tax Relief Program is now open for 2026, with applications accepted from January 1, 2026, through March 31, 2026. The program, implemented under Missouri Senate Bill 190 (SB190), aims to help eligible seniors manage rising property tax costs by "freezing" the real estate tax amount based on a "base year".

https://1027kearneymo.com/kpgz-news/2026/1/2/2026-senior-property-tax-relief-enrollment-period-open

Senior Real Estate Property Tax Relief Program Overview for 2026 - YouTube

NaN / NaN In this video Transcript Description 2Likes 178Views Jan 22026 Transcript Follow along using the transcript. Show transcript Transcript Show more...

https://www.youtube.com/watch?v=mrwVGDIAtrE

Office of the Clay County Property Appraiser – Tracy Scott Drake – Official Website of the Office of the Clay County Property Appraiser

If you have questions or need information, you may submit a request here or call the office at (904) 284-6305. If you need to visit our office, an appointment is not required or necessary. Homestead and Other Property Tax Exemptions: Florida law requires an applicant to have legal title or beneficial title in equity to real property and meet all eligibility requirements as of January 1 of the application year.

https://www.ccpao.com/

Seniors, it’s time for the 2026 application and renewal period for the Senior Real Estate Property Tax Relief program. You can find out more, on how to apply or renew, and of course the links and forms to apply over at https://www.claycountymo.gov/sb190 The average age of first time homebuyers in the US is 40 years old.

https://www.instagram.com/p/DS-HvwOk_Tg/

County Assessor Clay County, MO

County Assessor In order to log in through the link below use your account number and pin mailed out in early January and once logged in; buttons at the bottom of each page will guide you through each step of the process.

https://www.claycountymo.gov/208/County-Assessor

Real Estate Investing in Clay County MO [2026 Analysis] HouseCashin

Overview Clay County Real Estate Investing Market Overview Over the last decade, the population growth rate in Clay County has an annual average of 1.25%. The national average during that time was 0.69% with a state average of 0.31%. The entire population growth rate for Clay County for the past ten-year period is 11.23%, compared to 2.83% for the whole state and 6.23% for the United States.

https://housecashin.com/investing-guides/investing-clay-county-mo/![Real Estate Investing in Clay County MO [2026 Analysis] HouseCashin](screenshots/clay_county_missouri_real_estate_records_15.jpg)

Clay County MO Personal Property Tax Guide 2026

Introduction Have you ever wondered about the Clay County MO personal property tax? It’s a type of tax that people in Clay County, Missouri, pay on things they own that can be moved, like or boats. This tax helps pay for important things in the community, such as schools, roads, and fire stations.

https://tosinowocpa.com/clay-county-mo-personal-property-tax/

Clay County expands property tax relief

CLAY COUNTY, Mo. (KCTV) - Clay County seniors may get more property tax relief under a program expansion approved by the Commission. The Clay County Commission says it approved the changes on Thursday, Jan. 8. The update expands the Senior Real Estate Property Tax Relief Program to cover more types of taxes.

https://www.kctv5.com/2026/01/10/clay-county-expands-property-tax-relief-seniors/